Business Briefing: Key Steps for Project Success & Design

Introduction

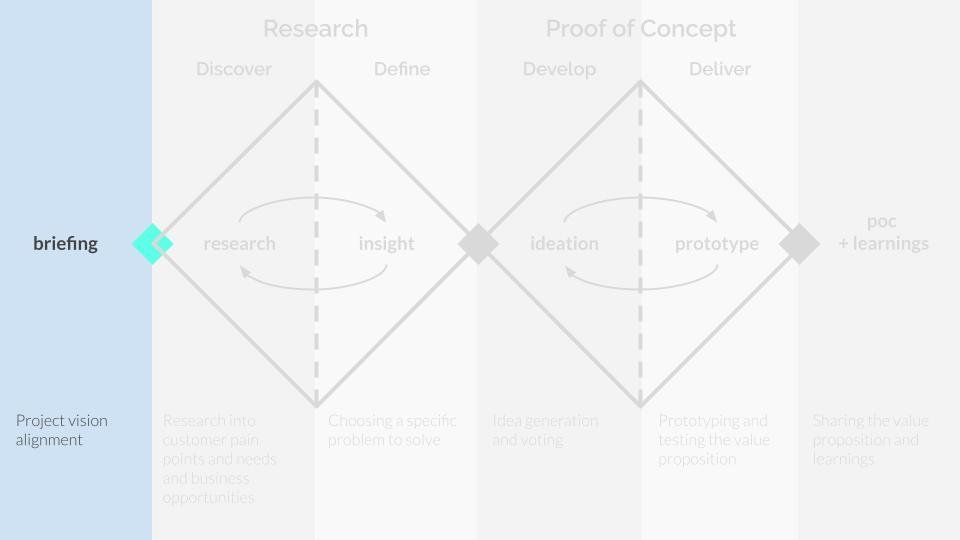

In every project, at least in all the ones I have collaborated on, there is a stage called Business Briefing, which consists of two activities: Kickoff Meeting and Interview with Stakeholders. In this stage, the main stakeholders discuss various aspects of the project (e.g.: what it is, why it is done, what they expect from it, etc.). It is at this moment that Designers have the opportunity to participate and contribute by asking questions to stakeholders so that what is extracted from them will help in Design decisions.

Why is it important to do a Business Briefing?

It is important because we always need to keep the business aspect in mind when we are going to create a product or service. In addition, we have an infinite number of things that we want to find out from our customers and without the briefing we can get lost in this. Therefore, the briefing guides the next step (Research).

Therefore, before we want to jump straight to Research, we need to interview the stakeholders involved in the project. In the project approach diagram, which I explain step by step in another article, we are in the briefing stage.

What to do at this stage?

At this stage, we need to do two things at different times:

- Participate in the kickoff meeting and ask questions.

- Identify the key stakeholders of the project and interview them following a script containing questions that will help you in the next steps.

During the Kickoff Meeting

Q: What is the problem or need we are trying to solve?

A: We have seen the growing emergence of fintechs and digital banks. We also want to create our digital bank to provide a differentiated banking service to people, saving them from abusive fees, poor service and bureaucracy that wastes their time, one of the most valuable assets today.

Q: What does the product or service need to do?

A: Our product is a digital bank that offers banking services that need to be accessed through a mobile app. The product must allow:

- People to go through the entire process of opening a digital account.

- Check their current account balance.

- Check their current account statement (what came in and what went out).

- Pay bills.

- Check their credit card statement.

- Make transfers (Pix, TED and DOC).

- Request service via chat within the app.

- Change the credit limit to the desired amount within a specified ceiling according to their credit score on SERASA.

- Withdrawals from ATMs 24 hours a day at a fee of R$1.97 per withdrawal up to R$500.00.

In addition, the customer will have access to a multiple card (debit and credit) to make national and international purchases. The card will have no annual fee.

Additionally, we will partner with entertainment companies (e.g. animation and film studios, publishers and retail establishments) so that we can allow customers greater ease of access to these types of services and customization of their cards.

Q: What is the business opportunity? (e.g., acquisition, activation, retention, revenue, referral, etc.)

A: Since we are creating a new product and service, we see, at this first stage, the acquisition and revenue opportunity for our business.

Q: What are the Key Performance Indicators (KPIs)?

A: At this first stage, they are:

Revenue indicators:

- Number of accounts opened (per day, per week, per month).

- Number of withdrawals at 24-hour ATMs (per day, per week, per month).

- Volume of financial resources that enter the bank’s cash register (per day, per week, per month).

Auxiliary retention and churn indicators:

- Customer satisfaction.

- Complaints in service channels.

Q: How else can we define success for this project?

A: We can define success for this project as the increasing number of checking accounts opened and the amount of money (volume of financial resources) people bring into the digital bank. Another point is customer satisfaction in using our product and the services we offer.

Q: How does this product fit into the overall strategy?

A: This product fits into the core of the company’s strategy, since we are creating a digital bank, the product is the way people will become our customers and a point of contact with our services.

Q: Who are the users or customers?

A: Initially, our customers are individuals who live within the national territory.

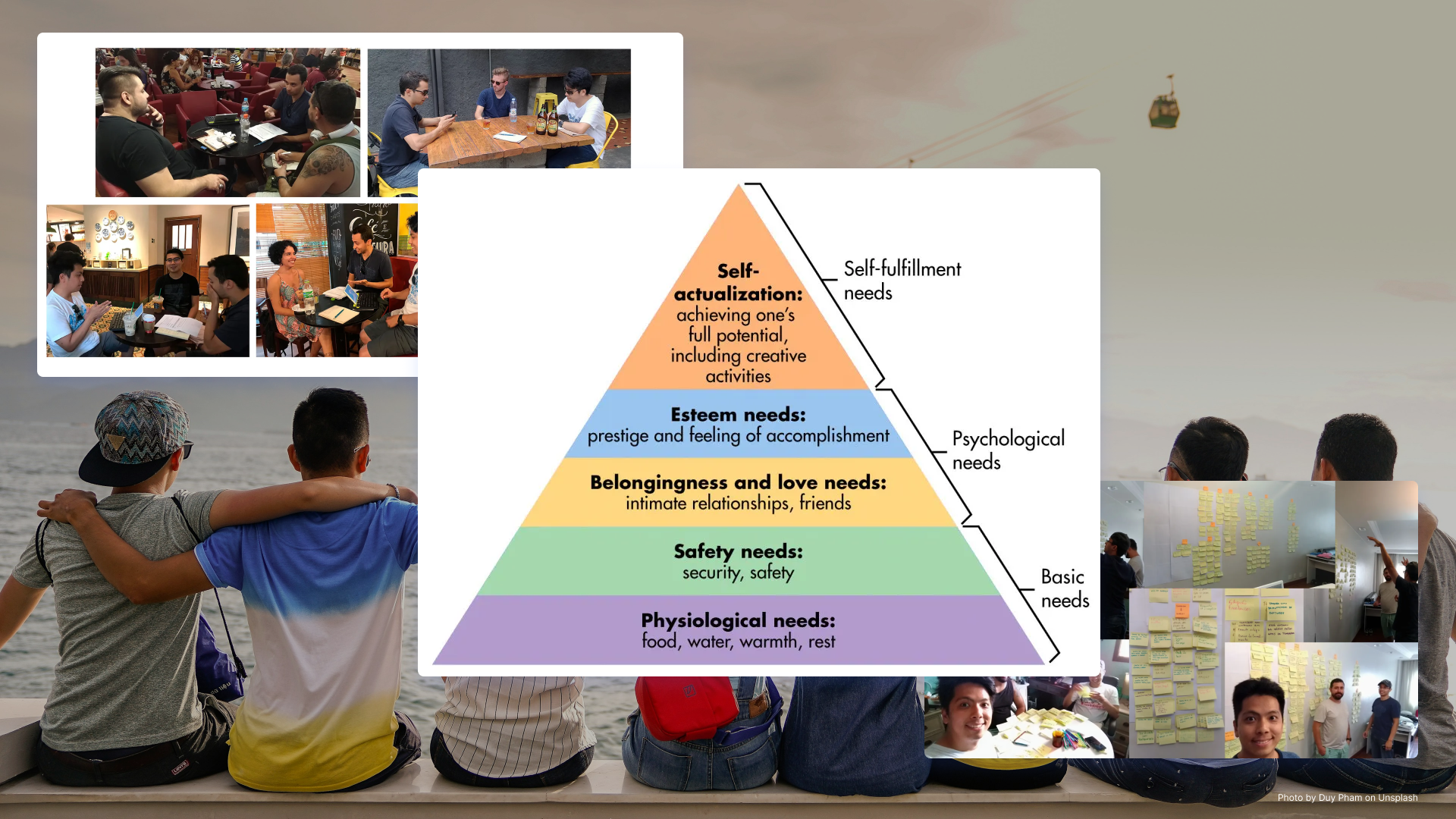

Q: Why is this important to them?

A: Today, there are dozens of digital banks and fintechs in Brazil. People are free to choose to open their bank accounts with any of them. However, when faced with the products and services that existing digital banks offer, they notice that their needs are not met in the best way, causing great frustration. This is where we will work to prevent people from becoming frustrated with our product and services.

Q: Why do they care?

A: As per the previous question, people value a product that is easy to use, without barriers, and that is objective and to the point. In addition, they appreciate services that are fast and have good customer service. We will offer all of this to people. We will focus on what matters to them.

Q: What are users trying to do?

A: People want a digital bank where they can trust to deposit their financial resources, to be able to make their transactions, pay their bills and make purchases with their card. For them, the bank is just a tool in their daily lives that allows them to have access to other services and products that are important in their lives.

Q: What are their pain points?

A: We think that people suffer a lot from bureaucracy, high fees charged by other banks and poor service.

Q: How can we reach users through this design process?

A: This design process includes user research, the use of tools that allow us to get closer to them (empathy map, value proposition, task flow, usability testing).

Q: Are there any constraints (technological, business, etc.)?

A: There are currently no constraints. We have a qualified technical team to develop the product, marketing, sales, design, operations and service.

Q: How are we better than our competitors?

A: Our product, the digital bank, stands out due to its lack of bureaucracy, zero administration fees, partnerships with other companies, proximity to customers and impeccable service.

Q: Are there relevant products that we can analyze?

A: Yes. We can analyze the digital banks that are on the market to identify their strengths and areas for improvement.

Q: Who are the main decision makers in this project?

A: They are:

- Bruce Wayne — Chief Executive Officer

- Clark Kent — Chief Financial Officer

- Diana Prince — Chief Marketing Officer

- Barry Allen — Chief Technology Officer

- Arthur Curry — Chief Operations Officer

- John Jones — Chief Design Officer

Q: Is there any relevant documentation (personas, user flows, etc.)?

A: Since we are building the digital bank from scratch, we do not have this type of documentation yet.

Q: Are there brand guidelines?

A: Since we are building the digital bank from scratch, we do not have any yet.

Q: Is there a style guide?

A: Since we are building the digital bank from scratch, we do not have any yet.

Stakeholder Interviews

Individual interviews with stakeholders allow us to gain a deeper understanding of the business from each stakeholder’s perspective. In addition, it also allows us to identify what is most important in the project at an individual level. Here, we will highlight two examples of interviews.

Stakeholder: Bruce Wayne, the CEO.

Q: What is your role in this project?

A: I am the CEO of the digital bank and will be responsible for executive-level decisions.

Q: What do we need to get right to make this project worthwhile?

A: To unite business needs with customer needs so that the product is profitable and people engage with it.

Q: How will you personally define success for this project?

A: Our digital bank being a reference for other banks and top of mind for people when they want to open a bank account.

Q: What is the role of this project in achieving this success?

A: The way this project is developed will define whether we achieve this success. We need to have good execution. The idea is worthless if the execution fails.

Q: What are the objectives you need to achieve with this project?

A: I need the digital bank to become our main product and for it to be profitable for our company. This way, we can develop new products and services for our customers.

Q: What have you tried that didn’t work?

A: In the past, we tried to create a digital bank, but the project failed in its final stages.

Q: What went wrong in this case?

A: We didn’t combine the business vision and its needs with those of the customers.

Q: Who are the biggest competitors and what worries you about them?

A: The biggest ones are NuBank and Itaú. The first one because of its reputation and quick ability to attract customers and the second one because of its history and strong brand, in addition to its size.

Q: How do you hope to differentiate this product?

A: Our digital bank needs to look at where our competitors are failing and attack those points. In order to use their strengths, we need to use them as potentializers of our business.

Q: Where do you want the product to be next year, and in 5 years?

A: Next year, I want our digital bank to have reached the mark of 1 million active accounts, closing the year with an NPS between 9 and 10 and a high level of satisfaction among our customers. In 5 years, I want us to have reached the 10 million active account mark and maintain the NPS of the first year.

Q: What keeps you awake at night regarding your users?

A: If they are satisfied with our digital bank and consider using it as their main bank.

Q: What assumptions do you think you are making about your users?

A: That they no longer tolerate banks that charge fees, banks with bureaucratic processes and poor service. People want something that makes their lives easier, not something that is another headache to solve on a daily basis.

Q: What do you know for sure about your users?

A: People value fast service and resolution of their problems.

Q: What are the most common problems your users face?

A: We think that people suffer a lot from bureaucracy, high fees charged by other banks and poor service.

Q: What worries you about this project?

A: As I said before, we must avoid making the same mistakes we made in the past.

Stakeholder: Ororo Munroe, the Product Manager.

Q: What is your role in this project?

A: I am the Product Manager for the digital account and will be responsible for making decisions about where the product should go, how it will evolve, measuring and monitoring KPIs, keeping an eye on the market, monitoring the sales funnel with the Marketing team, liaising with the Technology, Data and Design teams and assisting the Product Owners in managing the backlog.

Q: What do we need to get right to make this project worthwhile?

A: We need to unite business needs with customer needs so that the product is profitable and people engage with it. In addition, we need to always be aware of market developments and changes in customer behavior, as new needs emerge from time to time and we need to meet them to remain competitive.

Q: How will you personally define success in this project?

A: Our product should be easy to use, people-centric, and always engaging, so that they recommend it to their friends and family.

Q: What role does this project play in achieving this success?

A: Since I have a vision for the product, its success will depend on how we develop this project. All the data and insights that each stage of the project will bring will be vital when deciding where the product will go. It will define whether we take a step forward or take a step back towards success.

Q: What are the goals you need to achieve with this project?

A: I need this product to bring great returns to our company. I want the digital account to be one of the ways that will gradually bring more customers to our company. In this way, with the growth of our customer base and the use of our product, we will bring more financial resources to develop new products and services.

Q: What have you tried that didn’t work?

A: In the past, we have tried to create a digital account, but the project failed in its final stages.

Q: What went wrong in this case?

A: We didn’t listen to people and their needs, what they expected from a digital account, what was most important to them. In addition, we also failed to align internally and listen to the needs of each stakeholder.

Q: Who are the biggest competitors and what concerns you about them?

A: The biggest ones are NuBank and Itaú. What worries me about NuBank is its popularity. People are eager to get their NuConta and have the purple card in their wallets. Their product is very good. I use it myself and I like it a lot. As for Itaú, my husband has had an account there for years and has rarely had any problems. He always tells me to trust the big banks more because they are solid. I see Itaú as a complete bank that offers a wide range of products for the most diverse needs of each customer.

Q: How do you hope to differentiate this product?

A: The difference with our digital account is that it will adapt to our customers’ needs. It will be flexible enough to meet those needs, helping customers achieve their goals and not just being another obstacle in the way that causes headaches in their daily lives.

Q: Where do you want the product to be next year, and in 5 years?

A: In the next year, I want our digital account to have evolved in the services it provides to customers and for its ease of use to be approved by 60% of customers. In addition, I also want 80% of our customers to recommend our product to friends and family and to have at least a 30% month-to-month retention rate. In the first year, I want customer engagement to be high, for them to use it at least twice a week and for each session to last 5 minutes on average.

In 5 years, I want these numbers to be higher. Ease of use approved by around 75% of customers, recommended by 90%, month-to-month retention rate of 50%. As for product use, we use it 2 to 3 times a week with an average session duration of 5 minutes, as we want the digital account to be a tool that gives our customers more time to focus on what really matters in their lives.

Q: What keeps you up at night regarding your users?

A: In addition to wondering whether they are satisfied with our digital bank and consider using it as their main bank, I also wonder whether they will understand our value proposition, whether they will be able to use our product and recommend it to others.

Q: What assumptions do you think you are making about your users?

A: From the perspective of the digital account product, users do not like bureaucratic and flawed account opening processes. In addition, bank customer service leaves much to be desired; people spend hours waiting for a response, looking at the app’s chat, or even at branches. This is very frustrating for them.

Q: What do you know for sure about your users?

A: People value fast service and solutions to their problems. The digital account will allow this, from the first contact to the support of customers on a daily basis.

Q: What are the most common problems your users face?

A: Thinking about digital accounts, people still face problems when opening an account, with some operations such as Pix or the servers failing or not being as instantaneous as they say, checking account balances, invoices and credit limits are not updated quickly. In addition to the flawed customer service.

Q: What worries you about this project?

A: Making the same mistakes we made in the past. Furthermore, we must be aware of the insights we will gain from each stage, as in the past we did not pay attention to this. In fact, we did not even think about obtaining insights to guide decisions.

Conclusion

In this article, we saw the importance of doing a business briefing, because in addition to collecting information that will help us in the next stages of the Design process, we can also create empathy with the stakeholders and their buy-in in our work, especially when we are going to present the results of the Research and their participation in the workshops. I hope this article has helped you understand the reasons for this important step and how to apply it in your next project!